OlympusDAO

Researcher: Adam Patel

Key Takeaways:

OlympusDAO presents a tokenomics model of protocol owned liquidity (POL)

OHM Staking APY is ~7,000%, but could decline over the next few months

Project Overview:

OlympusDAO is an algorithmic currency protocol that launched in March of 2021. Instead of being pegged like stablecoins, it’s backed by a pool of reserve assets including stablecoins and crypto blue chips. Its long-term mission is to become a global unit-of-account and medium-of-exchange through building a policy-controlled currency system. In recent years, crypto has increasingly become “dollarized” with 50%+ transactions being cleared in stablecoins; while volatility is surely to blame, this trend defeats a key point of decentralized currency as the ecosystem is still largely at the mercy of a human-controlled Fed. The project also sought to better manage its liquidity after seeing whales destroy projects with quick rug pulls during DeFi Summer.

The OHM token will always be backed by $1 DAI in the DAO’s treasury, acting as a floor price; thus, the price is always $1 plus a premium. The tokenomics were designed to optimize growth and wealth creation. People can either stake or bond OHM. Stakers lock their supply to receive a share of the protocol’s profit, with the majority of OHM going to stakers. To profit, stakers simply need to have the increase in tokens (APY) outpace the token’s price change. To attract as much liquidity as possibly, the protocol’s APY is around 7,000%, down from almost 300,000% APY at launch. The APY is expected to drop over the next few months. The “(3,3)” symbol has been popularized by the project’s supports; it refers to a game theoretic equilibrium of the most beneficial and cooperative outcome. Approximately 90% of the circulating supply is staked.

Bonders provide liquidity or assets to the protocol with a specific lockup period; in return, they receive OHM at a discounted price. Their profit depends on the price movement of OHM. The long-term goal is to move holders from staking to bonding, and the contributors expect this change to occur as the APY is lowered.

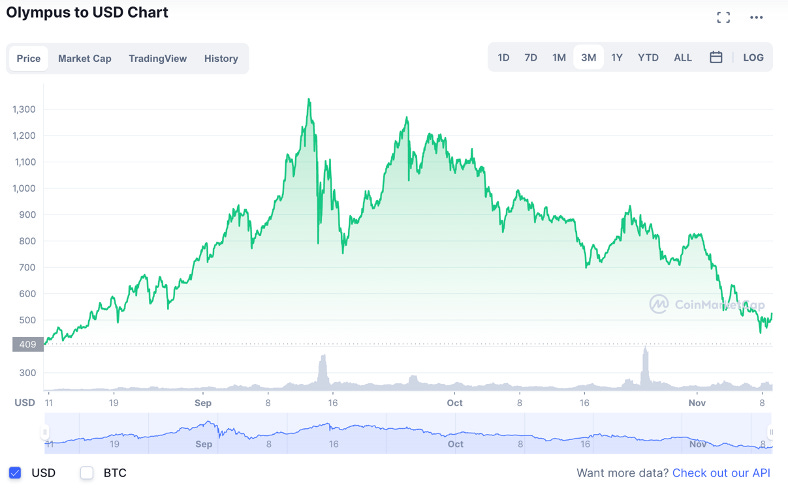

Interestingly, it can thus be argued that in the long run the price of OHM is irrelevant. With APY so high and a floor price, the growth of a staker’s total number of OHM would eventually outpace any price decline. Additionally, in the event of a price crash, the DAO could increase staking APY (as it has in the past) to lock-in supply and attract more yield-searching buyers, putting upward pressure on the token’s price; in fact, past swings have seen significant support from whales at the low $400s. OHM also experiences its own mini cycles; in its early iteration, changes to APY had a disproportionate impact on the token’s price.

The project has famously seen numerous forks, with others – including AladdinDAO – implementing elements of its unique tokenomic model. Prominent examples include KlimaDAO and RomeDAO. KlimaDAO’s mission is to help prevent climate through increasing the price of carbon with its native KLIMA token, which is backed by real carbon assets. RomeDAO launched on Moonriver and is intended to be the equivalent of OHM for the Kusama and Polkadot ecosystem. Both projects came out of the OlympusDAO Discord server and are assisted by the Olympus contributors.

The project also recently released the Olympus Pro product. To discourage forks and help other DAOs control their liquidity, Olympus writes the code for their partners, assists them with marketing in the broader DAO community, and lists the project on the front-end of the Pro website. Olympus charges a fee for these services in the project’s native token, which enters the Olympus treasury; however, given their reserve requirement, Olympus will likely never sell the asset, effectively making the partner’s token scarcer.

Olympus’s has seen impressive traction. The DAO’s treasury is tracking around $200m. There are 80k+ OHM holders, and the token has a circulating market cap of ~$750m. Notably, the project has generated $25m in LP fees, showing the income-generating capabilities of protocol owned liquidity (POL). With no bonding revenue, Olympus can even afford to sustain its staking rewards for 375 days.

Opportunities:

At current levels, staking OHM can still generate ~7,000% APY, although it is expected to decline over the next few months.

The project has received considerable traction; it is considered a pioneer of POL tokenomics and a key player in the broader “DeFi 2.0” wave.

In the event of a bear market, POL would lead to less severe price drops given the mathematics of constant-product AMMs.

There has been considerable demand for Olympus Pro; the project is accepting DAOs in cohorts and has a waiting list of ~30. The product not only generates additional revenue, but also increases the Olympus community and brand.

Considerations:

The project is still considered highly experimental, and it remains to be seen whether token holders are long-term investors or hunting short-term APY.

The project admits that APY will be lowered, and the market has reacted somewhat aggressively to these changes in the past.

Unlike other yield strategies proposed by the Boule, staking OHM accepts considerable price risk of the native token rather than lower-risk stablecoin yield strategies.

Disclaimer: This content is intended for informational purposes only; readers should not consider it investment, financial, or other advice. This message also contains forward looking statements; there can be no assurances that these statements or any others in this message will prove accurate, since actual results and future events could differ significantly from those anticipated due to unforeseen events. AladdinDAO has no obligation to update these statements. The reader is cautioned to do their own research and understand that certain investments involve a high degree of risk.